I posted on this topic few days back in Investing the MF's, the right way. I thought just the fact that direct funds have lower expense ratio and better annualized returns it would be more than enough to make the decision to go the direct way.

However, today while in a discussion with someone on the topic, I got an argument stating how much would that 1% difference in expense ratio make against the convenience of investing in Mutual Funds through one portal and viewing your consolidated portfolio at one place. A valid argument, hence i thought let's do some number crunching to see what is the quantum of benefit one is trading for the convenience.

I picked up three toprated funds from valueresearchonline.com, and simply checked the delta between their corresponding direct and regular plans. I picked only till 3 years as Direct funds came in to existence around 2013.

Note, that direct plans always always always have more returns than corresponding regular plans.

Observe that typically there is a delta of more than 1% in annual returns of these funds, and this is coming from the expense savings done on commissions to brokers.

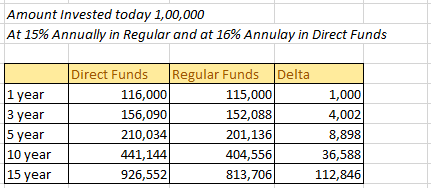

Over the very long periods, the more realistic annualized returns for an equity funds would be in the range of 12-18%, expecting anything more than that is sheer luck. So, let's consider what would be the value of 1 lakh invested today at different periods for an annualized return in a regular and direct variant of a mutual fund giving 15% and 16% respective returns.

This may not look huge, but consider the fact that we used just one lakh as investment. Now, consider someone investing over a crore and building a retirement corpus and let's see how the numbers looks like now. The corpus at the end would differ by more than 1 crore.

However, today while in a discussion with someone on the topic, I got an argument stating how much would that 1% difference in expense ratio make against the convenience of investing in Mutual Funds through one portal and viewing your consolidated portfolio at one place. A valid argument, hence i thought let's do some number crunching to see what is the quantum of benefit one is trading for the convenience.

I picked up three toprated funds from valueresearchonline.com, and simply checked the delta between their corresponding direct and regular plans. I picked only till 3 years as Direct funds came in to existence around 2013.

Note, that direct plans always always always have more returns than corresponding regular plans.

|

| Annualized returns for three large cap funds for 1 and 3 years period |

Over the very long periods, the more realistic annualized returns for an equity funds would be in the range of 12-18%, expecting anything more than that is sheer luck. So, let's consider what would be the value of 1 lakh invested today at different periods for an annualized return in a regular and direct variant of a mutual fund giving 15% and 16% respective returns.

|

| Value of 1 lakhs over different periods in investments with 1% delta returns |

Now, you may debate how much value a 1 crore would have after 15 years, that's totally up to you. But this is really called the power of compounding. What do you think?

1 comment:

Nice Post thanks for sharing

precious metals free commodity tips

Post a Comment